Everywhere we go, clients and friends ask: “What’s happening in the real estate market?” It’s not booming--but it’s far from crashing either.

In this month’s newsletter, I’ll break down how the interest rate cut’s impact, how our local market fits into a historical context, and how Stratford stacks up against the province.

So, let’s focus on three questions:

Did September’s interest rate decision do anything?

Where does the market sit historically?

How does Stratford compare to the rest of Ontario?

Did September’s interest rate cut do anything?

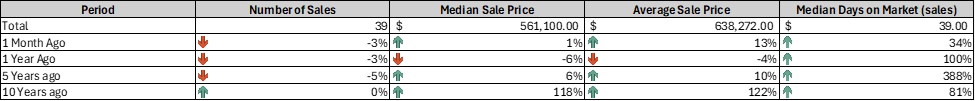

If it did, we’d expect faster sales, more homes sold, and higher prices. Here’s what actually happened:

Sales: Flat or down 3% month-over-month (typically October is slower), and down 3% year-over-year. It was a slower October than we have seen, but the trend is neutral, historically speaking.

Prices: Up 1% or 13% month-over-month (depending on how you measure it), but down 4% YoY year-over-year.

Time to sell: Up, 34% month over month, 100% compared to last year. This is the big trend: houses are taking far longer to sell.

market snapshot

Putting this all together, about the same number of houses sold, it took longer, and prices are down a bit year over year, but up from last month. So… not exactly a “yes.”

One encouraging sign: showings increased from September to October, from 771 to 805, suggesting that buyers are active--but not rushing. With more listings to choose from, and expectations still shaped by the red-hot years of 2020–2022, it’s natural that sellers and buyers are adjusting slowly. After all, those last five years were anything but normal.

So let us take a look.

Where does the market sit historically? - Putting things in context

Our perceptions of things are based on the past; if your drive home from work takes 10 minutes and then one day it takes 30 minutes. You’re likely to pull your hair out. Vice versa, and you’re having a great day.

So, when people ask us about the market and we say it’s down, it helps to clarify what 'down' is compared to.

It is common knowledge that Covid was a good time to sell your house and that the combination of low interest rates, work-from-home moves, people having nothing to do but browse realtor.ca, and strong population growth created a red hot housing market. So, to understand today’s housing market, let's compare the current market to the COVID market, then again to the pre-COVID market. We will examine days on market and prices over a five-year period, then zoom out to see where the past five years stand in comparison to the past.

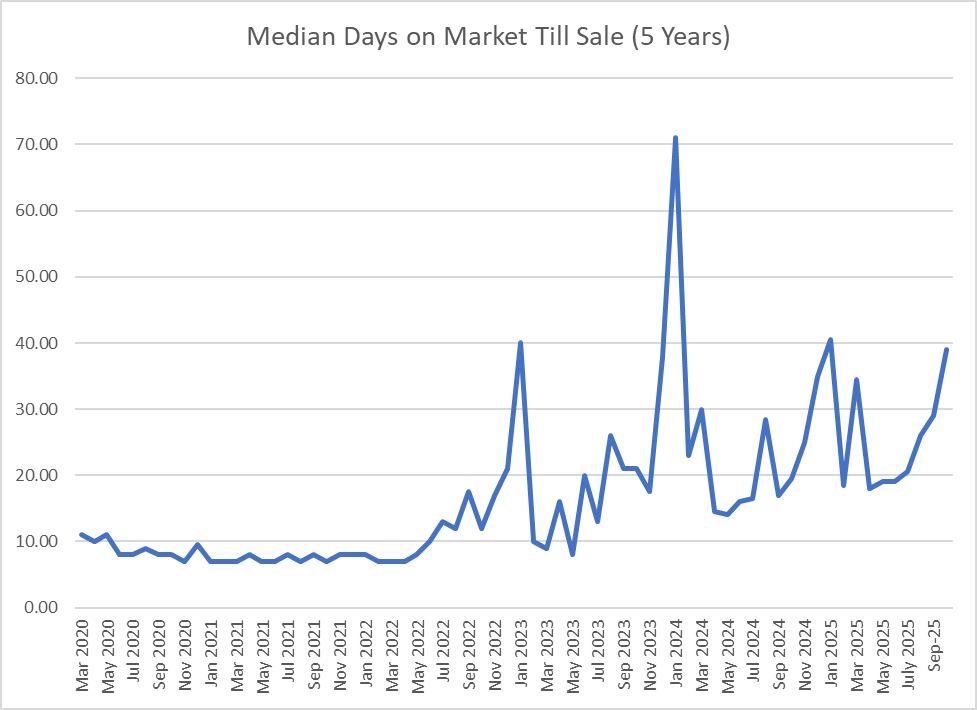

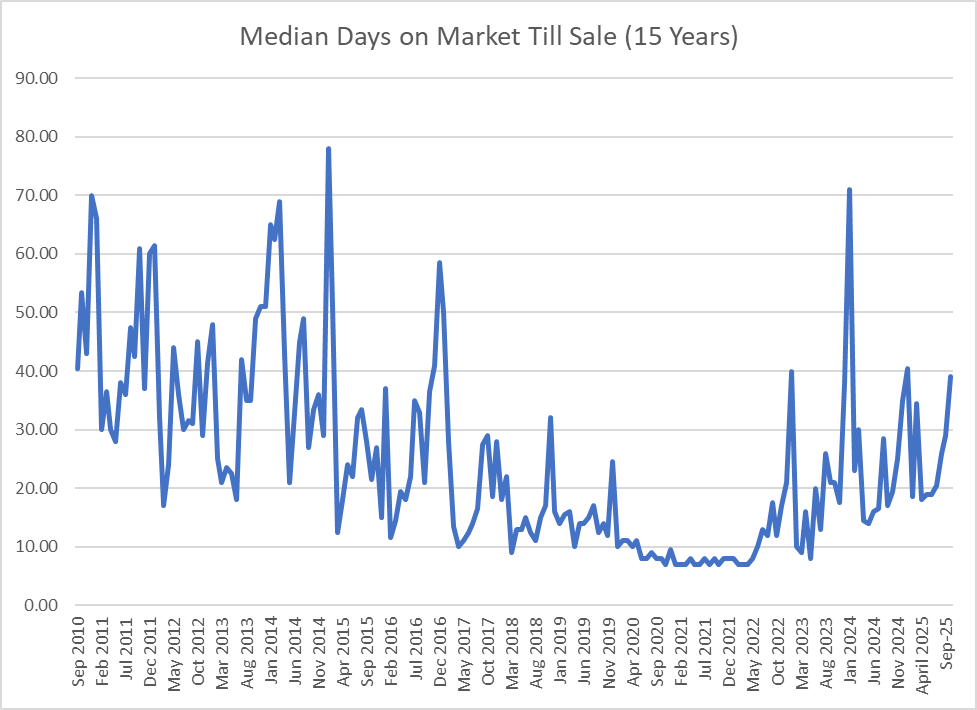

Days on Market (How long does it take to sell a house)

At first glance, this chart, which shows how long it takes the median (middle-of-the-road) house to sell, looks alarming. But zoom out, and it tells a calmer story:

Median Days on Market Stratford- 5 Years

Median Days on Market Stratford- 15 Years

Homes are taking longer to sell -- but if you zoom out, you can see that, historically speaking, 39 days on the market for a sale is slow, but not unprecedented. In fact far enough back it used to be the norm. Personally, I don’t remember the real estate crashes of 2010, 2011, 2012, 2013, 2014, 2015, or 2016; other years when houses took 39 days to sell.

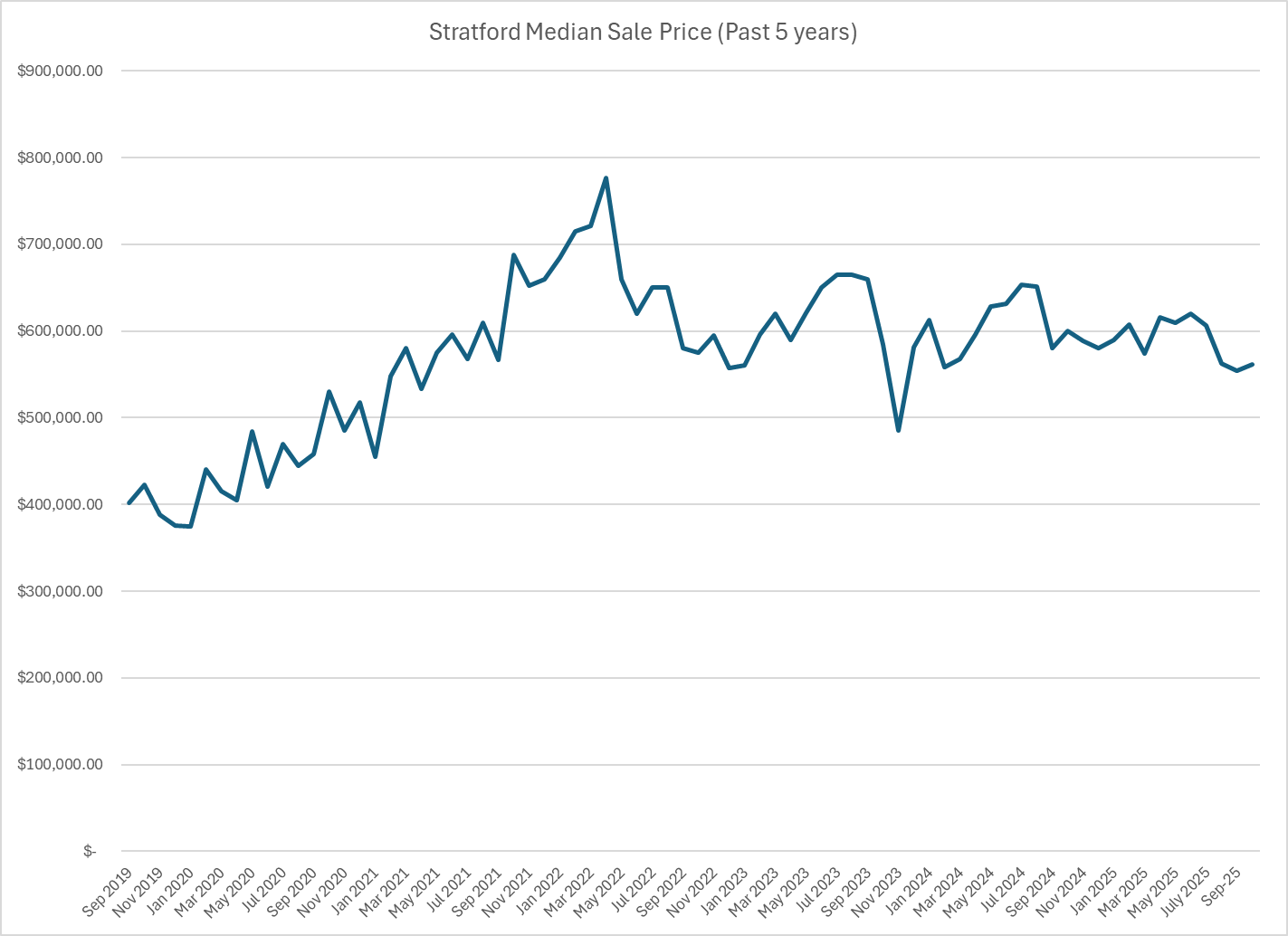

Prices:

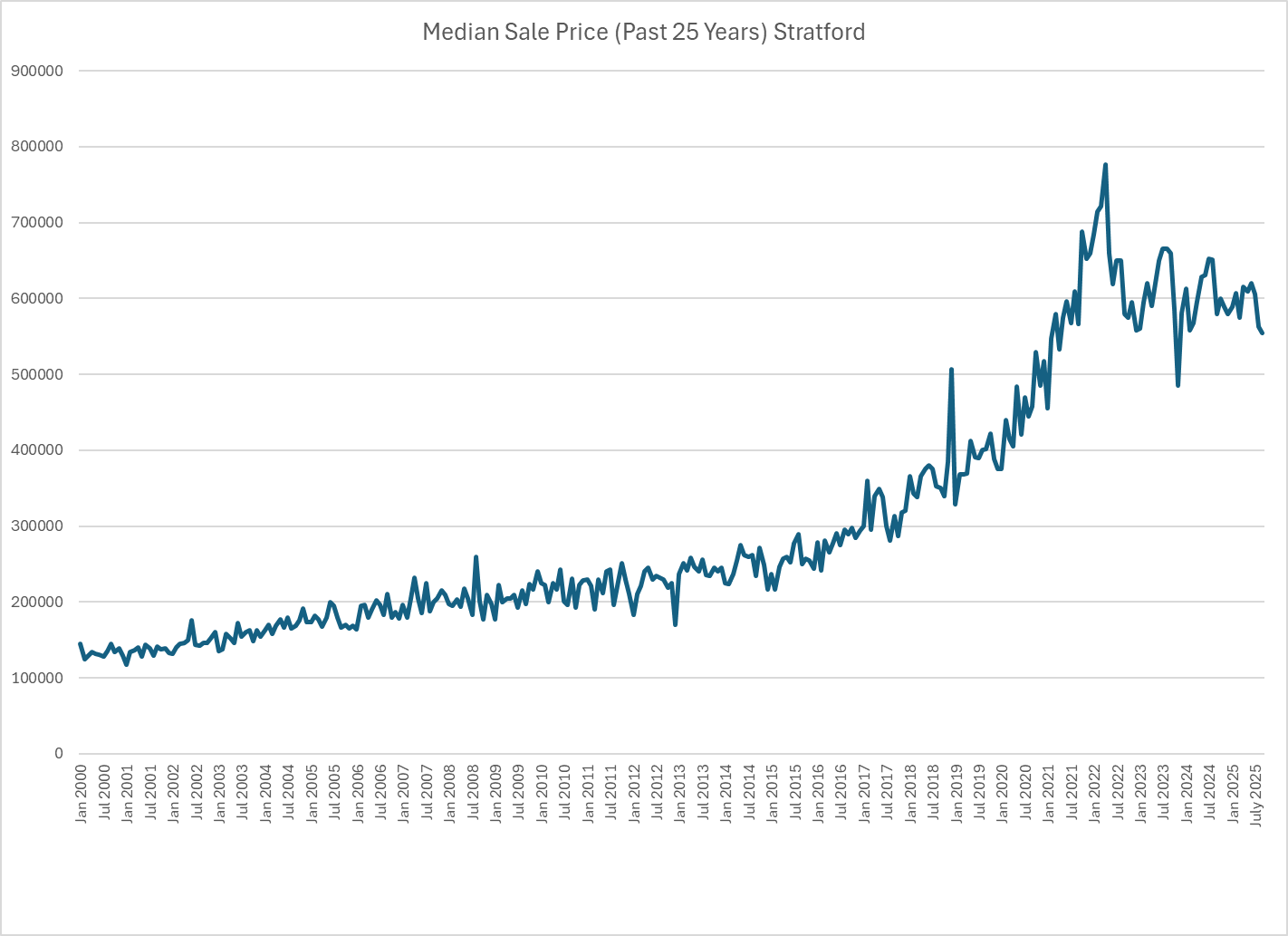

The chart below shows what the median house sells for in Stratford.

Here, prices climbed steeply during COVID and have since levelled off. Over the past five years, unless you bought right at the 2021–2022 peak, your home is likely worth about the same or more than when you bought it.

Stretch that view out to 25 years, and the picture gets even clearer: homeowners come out ahead. Even those who bought in 2007--right before the Great Recession--saw their values hold steady for years and then rise sharply after 2015. During that time, they built equity and had a place to live.

That same pattern applies now: eventually, and it could be a while, those who bought houses at the COVID peaks will be worth the same as when they purchased them. In the meantime, they will have built equity and owned the place they live.

However, going back to COVID, the music had to stop at some point. In Stratford, where the median two-or-more-person combined household income is 100k (2020 census), we were on trend for a starter home to cost 700k, something that isn’t sustainable or desirable. In the long term, a healthy housing market keeps pace with rising incomes.

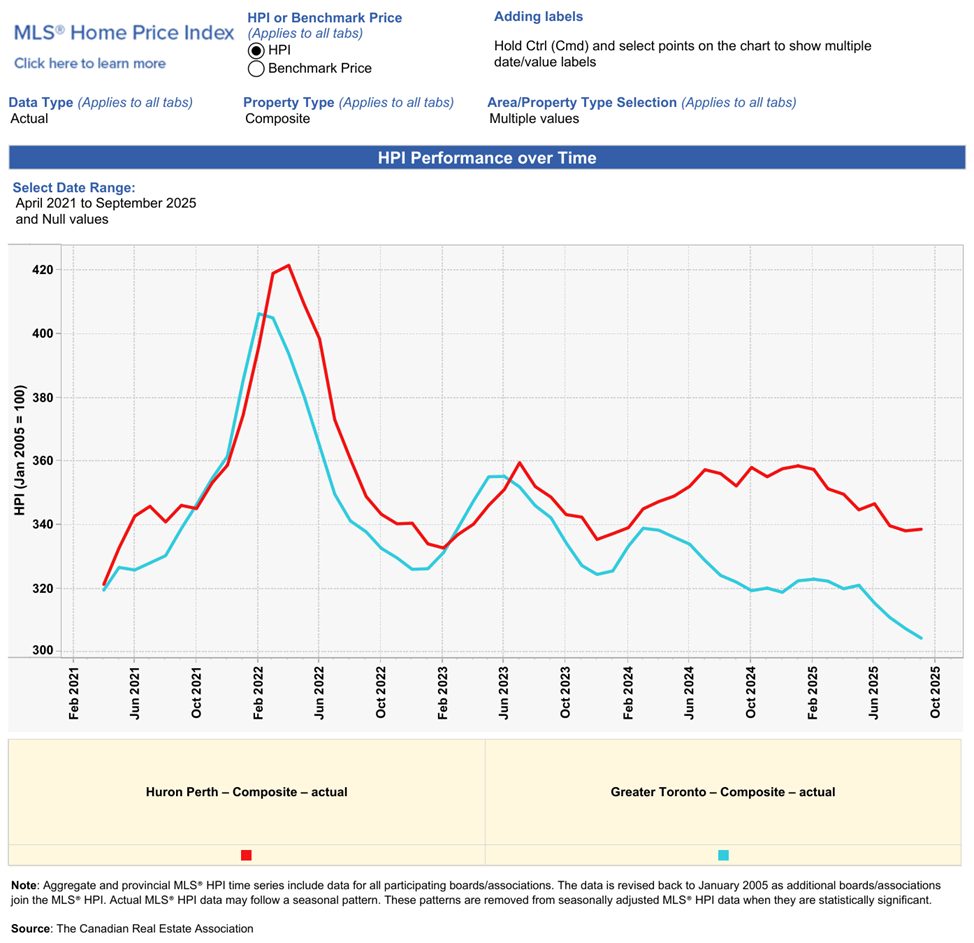

How does Stratford compare to the rest of Ontario?

Comparing Huron–Perth to Toronto, where many headlines have emerged from, house prices have remained more stable here.

Where does the market go from here?

If I could answer that question with certainty, I would be on a yacht somewhere and not writing this newsletter.

But in reality, it’s hard to say: we sell houses, and our clients buy houses. Things are moving. But it’s unlikely that we will see a return to the COVID-era housing craziness.

Further, we expect the recent rate cuts to help stabilize the market here in Stratford. If consumer confidence and the situation with the country south of the border stabilize or improve, prices will start to stabilize. At the same time, many sellers are waiting for the market to improve. While enhanced consumer confidence and an economic rebound will likely boost buyer confidence, the increased number of houses on the market may offset this and keep things flat.

If you’re curious about what your home is worth in today’s market, we’d be happy to help.

What This Means to You

• Buyers: More inventory and stable prices mean better choices and more negotiating power. If you're eyeing a home in Stratford, there are deals to be had. We can help you get the most house for your dollar.

• Sellers: Gone are the days of putting your house on the market, dirty dishes in the sink, and attracting 10 offers. Selling your home and getting top dollar requires a careful, thoughtful approach, the right listing price, and professionals with experience to guide you through this process. This is not amateur hour.

• Investors: Our area's resilience compared to big cities like Toronto makes it a smart bet for long-term growth.

Our October Sales activity:

As for us, we are out of inventory and have five happy sellers.

61 Baker – List $850,000: SOLD

141 Norman – List $880,000 SOLD

11 Water Street – List $750,000 SOLD

183 O'loane Avenue S - List 885,000 SOLD

65 Sir Adam Beck - List 1,295,000

Till next time,

Maklane

519-301-2214